4 Keys to Decoding Financial Plans & Projections

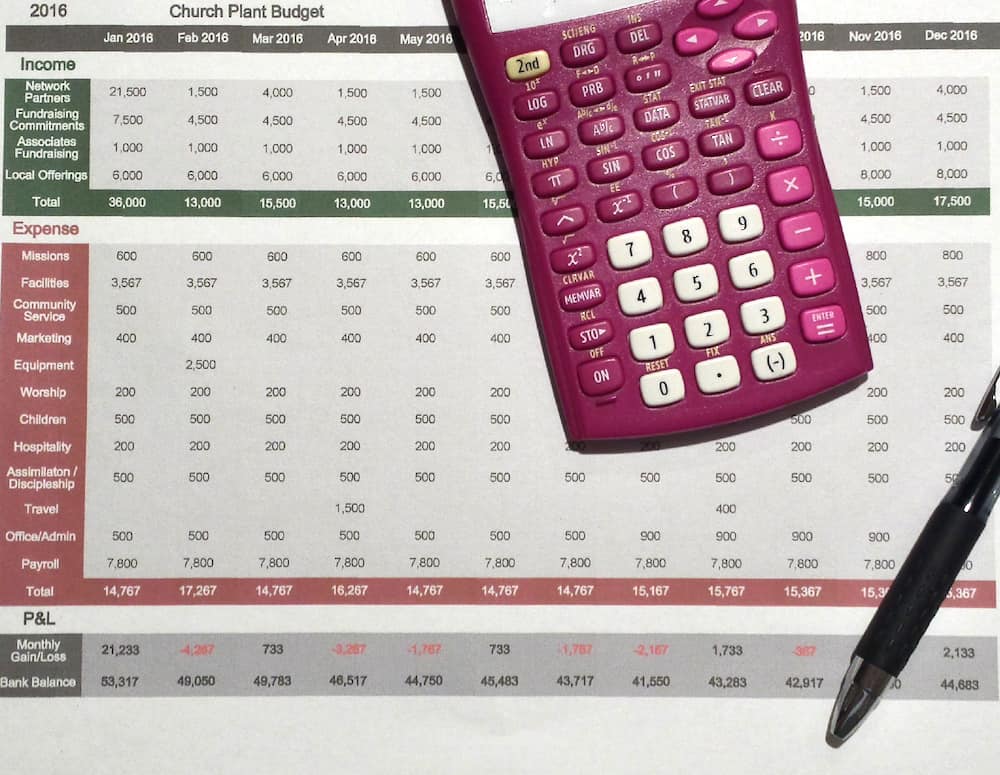

You’ve been there – someone has handed you a departmental or church budget and your eyes glaze over. Reading financial charts and spreadsheets is not why you got in to ministry. But now you’re overseeing a church plant and you need help with how to review a church plant budget.

I work with church planters and mother/network churches that send them out. I’ve seen the deer-in-the-headlights look from more than one network partner that’s sitting in front of a proposed church plant budget. There was no Church Budgeting 101 class at seminary.

But reviewing church plant budgets can be easy if you know what to look for. Here are 4 keys to unlocking the mysteries, each with some sample questions to ask yourself as you learn how to review a church plant budget:

1. Priorities

A church budget is really a vision document. It will be an exposé on where the planter’s real priorities lie. For example, does the planter’s vision include reaching children at risk? Then show me the money.

Ask questions like these:

- Does this budget line up with the vision of the church?

- What does this budget suggest the church’s most important ministry is?

- How much money are we spending on community service vs. marketing?

2. Cash Flow

This technical-sounding phrase just means the timing of when the money comes in and goes out. If the planter has a big expense in July but the check from the network/denomination isn’t anticipated until August, that’s not going to work. A budget laid out in a monthly grid will flush hidden cash flow problems out of the bushes.

Ask questions like these:

- Do we have sufficient reserves to cover the startup expenses (equipment, etc.) when we’ll need it?

- What would happen to the overall budget if a particular major donation was delayed by a month?

3. Profit and Loss

Similar to Cash Flow, this has to do with money coming in & going out, but answers the question, “Did we put money away in savings this month or use up some of our savings?” It is usually measured or reported month to month. A couple of ‘loss’ months in a row is not necessarily a bad thing if you planned for those expenses and have the money set aside. But prolonged ‘losses’ aren’t sustainable in the long run.

Ask questions like these:

- What is the proposed overall gain or loss for the year?

- Which month has the biggest change in either gain or loss?

4. Bottom Line

Once all the numbers are crunched for each month, you should have a forecast for how much will be in the bank at the end of each of those months. So, figure out how much you start with at the beginning of the month, add in expected income, and then subtract anticipated expenses. That’s your bottom line

Ask questions like these:

- Is there any month when we’re likely to run out of money?

- How many months’ worth of expenses will we have in reserves? (for instance, if your expenses usually run $10,000/mo, 2 months’ reserves would equate to $20,000 in the bank)

No Rubberstamping

A budget is a very important part of the church planting process. Whoever oversees the church planter has to understand the proposed budget and foresee the future it is leading him into. Whether you’re a supervisor or representing some version of a Board, you can’t let your faith in the planter turn in to a rubber stamp for his budget. Using these questions, you’ll quickly learn how to review a church plant budget with confidence.

Leave a Reply