As a church planter, you’re likely to have at least one church address change in the first few years of your church. When you change the church’s address, there are a whole heap of people that need to know.

Church Address Change Notifications

Send notifications or file address change forms with:

- The IRS (don’t want to miss notices from them!)

- Your online map/directory listings (SUPER important!)

- Secretary of State or Corporations Commission (depending on your state)

- State Department of Revenue (if you have any employer withholding accounts)

- State Attorney General (only in some states; might want to call & ask)

- the DMV (if the church owns a trailer or motor vehicle)

- Your bank

- Your payroll processor

- Your insurance company (liability & workers’ comp)

- Church copyright agencies

- The Post Office (file a change of address/forwarding form & have them update any postal permits)

- …anybody else that’s mailed you something important in the last several months

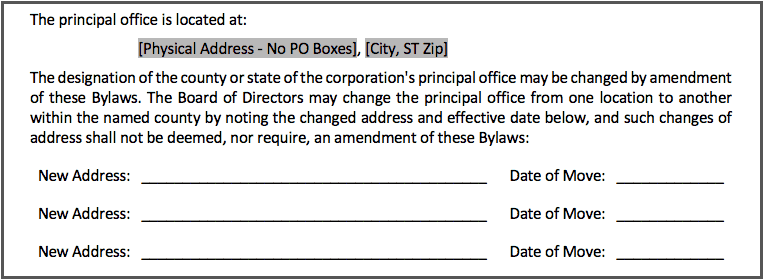

Update Your Corporate Records

Some of the church plants I’ve supported over the years adopted a Bylaws template that should be updated with each physical address change (think church office):

It would be a good idea to keep copies of the address change forms you mailed in to the various government agencies, too.

What Happens if You Don’t

If you don’t file your church address change with all of the entities on the list that apply to you, bad things may be heading your way:

- important bills get missed and not paid – like your church insurance or DMV tags

- unanswered tax notifications and forms pile up penalties

- un-filed annual reports cause your corporation to be dissolved by the state

- etc.

I sure wish a church address change were easier, but there you go.

Leave a Reply