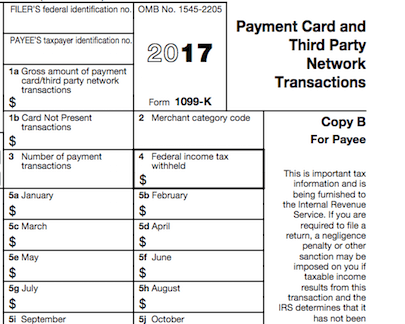

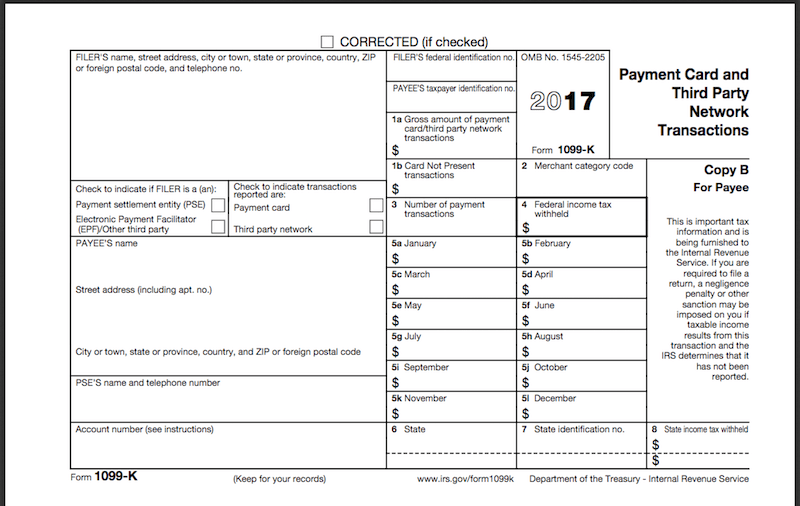

Most of you church planters are getting your church 1099-K right about now. Every year I get at least one frantic email asking about what the church should do. Here’s what you need to know:

What is a Church 1099-K?

The short answer is ‘just information’. It’s simply the total of all the credit card transactions you processed in the prior calendar year. Every organization or business that accepts card payments gets one. Your credit card processor sends one to you and a copy to the IRS.

According to the IRS, the 1099-K is “to improve voluntary tax compliance.” So it puts businesses on notice that they can’t hide taxable income. As a tax-exempt nonprofit, that doesn’t really have any effect on your church.

Also, since your church isn’t obligated to file a 990 tax return for its tax-exempt activities, there’s not any place you have to file or submit your church 1099-K.

Unless You Sold Stuff

I’m no accountant, but I understand that there are two basic categories of income for churches: taxable and non-taxable.

Offerings and donations that are given where there is no exchange of goods or services are in the non-taxable category.

But it’s pretty common for churches to sell T-shirts or charge fees to cover a retreat or other event. The IRS has allowed plenty of exceptions on calling that taxable income, but there may be sales tax owed to your state or local government.

Check with Your Bookkeeper or CPA

Probably the best thing you can do with your church 1099-K is hand it over to your bookkeeper or CPA. Ask them to do a couple of things with it:

- Double check that the totals on the 1099-K match up with their totals

- Make sure they’ve kept track of all taxable income and any sales tax-related items

As the pastor or ministerial staff, there’s not much more you can do with the church 1099-K. So get it to the right person and let them work their magic.